A Biased View of Pvm Accounting

A Biased View of Pvm Accounting

Blog Article

About Pvm Accounting

Table of ContentsThe Pvm Accounting PDFsFascination About Pvm AccountingA Biased View of Pvm AccountingHow Pvm Accounting can Save You Time, Stress, and Money.Getting The Pvm Accounting To WorkSome Known Details About Pvm Accounting

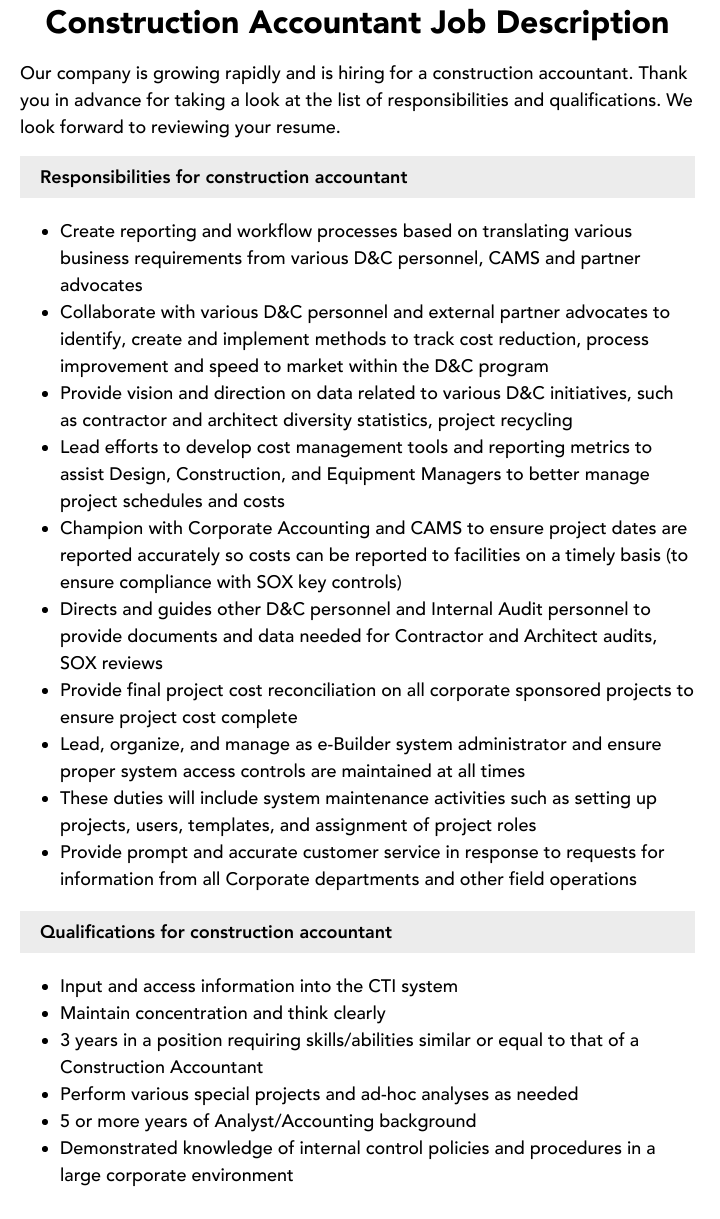

Manage and handle the production and approval of all project-related payments to clients to cultivate good interaction and prevent issues. construction accounting. Make sure that appropriate reports and paperwork are submitted to and are updated with the IRS. Make certain that the audit procedure follows the regulation. Apply required building accountancy criteria and treatments to the recording and reporting of building task.Connect with numerous funding firms (i.e. Title Firm, Escrow Business) regarding the pay application process and needs required for repayment. Help with carrying out and maintaining internal monetary controls and treatments.

The above statements are intended to describe the general nature and degree of job being carried out by individuals assigned to this classification. They are not to be construed as an extensive list of responsibilities, obligations, and abilities required. Workers may be required to perform tasks beyond their regular responsibilities periodically, as needed.

The Ultimate Guide To Pvm Accounting

You will certainly assist support the Accel team to guarantee shipment of effective promptly, on budget, jobs. Accel is seeking a Building and construction Accountant for the Chicago Workplace. The Building and construction Accountant carries out a variety of accounting, insurance coverage conformity, and project management. Works both separately and within particular divisions to preserve monetary records and ensure that all documents are kept existing.

Principal tasks include, but are not limited to, handling all accounting functions of the company in a timely and accurate fashion and offering reports and routines to the company's CPA Firm in the preparation of all monetary declarations. Guarantees that all accountancy treatments and features are taken care of accurately. In charge of all monetary documents, pay-roll, financial and everyday procedure of the bookkeeping feature.

Prepares bi-weekly test equilibrium reports. Works with Job Supervisors to prepare and publish all regular monthly billings. Procedures and issues all accounts payable and subcontractor settlements. Produces monthly recaps for Workers Compensation and General Responsibility insurance policy premiums. Produces month-to-month Job Cost to Date records and dealing with PMs to integrate with Project Supervisors' spending plans for each project.

Pvm Accounting for Dummies

Effectiveness in Sage 300 Construction and Realty (previously Sage Timberline Workplace) and Procore construction administration software application an and also. https://issuu.com/pvmaccount1ng. Have to also excel in other computer software systems for the preparation of records, spreadsheets and various other accounting analysis that might be required by management. financial reports. Must possess strong business skills and ability to focus on

They are the financial custodians who make sure that construction projects remain on spending plan, adhere to tax policies, and preserve monetary openness. Construction accountants are not just number crunchers; they are critical companions in the construction process. Their key duty is to handle the economic elements of building and construction projects, ensuring that resources are designated effectively and financial risks are decreased.

4 Simple Techniques For Pvm Accounting

By preserving a limited grasp on job funds, accountants assist avoid overspending and monetary setbacks. Budgeting is a keystone of successful building projects, and construction accounting professionals are important in this regard.

Browsing the complex web of tax obligation laws in the construction market can be tough. Construction accounting professionals are skilled in these regulations and guarantee that the project adheres to all tax requirements. This includes handling pay-roll taxes, sales taxes, and any kind of other tax obligation commitments particular to building. To stand out in the function of a construction accounting professional, individuals require a strong instructional foundation in bookkeeping and finance.

Additionally, certifications such as Certified Public Accounting Professional (CPA) or Licensed Building And Construction Industry Financial Expert (CCIFP) are very pertained to in the market. Building and construction projects usually entail tight target dates, transforming laws, visit their website and unexpected expenses.

The Single Strategy To Use For Pvm Accounting

Ans: Building and construction accounting professionals create and monitor spending plans, determining cost-saving opportunities and making certain that the job stays within spending plan. Ans: Yes, building and construction accountants manage tax obligation conformity for building tasks.

Intro to Building Accountancy By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building and construction companies have to make challenging selections among numerous economic options, like bidding process on one task over another, selecting financing for materials or equipment, or setting a job's profit margin. In addition to that, building is an infamously volatile sector with a high failure rate, slow-moving time to payment, and irregular cash money flow.

Typical manufacturerConstruction company Process-based. Production includes duplicated processes with quickly identifiable costs. Project-based. Manufacturing needs various processes, products, and devices with varying prices. Dealt with area. Production or production happens in a single (or several) regulated locations. Decentralized. Each job occurs in a brand-new location with varying site conditions and unique challenges.

How Pvm Accounting can Save You Time, Stress, and Money.

Regular use of different specialized service providers and vendors impacts efficiency and money circulation. Settlement arrives in complete or with routine settlements for the complete contract quantity. Some section of settlement may be held back until project completion even when the professional's work is finished.

While typical suppliers have the benefit of controlled environments and optimized manufacturing procedures, building and construction firms should frequently adjust to each brand-new task. Also rather repeatable projects need alterations due to website conditions and various other variables.

Report this page